Applied statistics is essential for data-driven decision-making in business and economics, providing tools to analyze and interpret data for informed strategies and outcomes.

Overview of Applied Statistics

Applied statistics involves the practical application of statistical methods to real-world problems in business and economics. It focuses on data collection, analysis, and interpretation to support decision-making. Key areas include descriptive statistics, probability theory, and inferential statistics. Tools like regression, hypothesis testing, and time-series analysis are commonly used. The field emphasizes the interpretation of results rather than theoretical concepts, making it accessible for non-experts. Textbooks like those by Doane, Webster, and Leekley provide comprehensive guides, covering topics from basic concepts to advanced techniques. These resources often include real-world examples, making statistics relatable to business and economic scenarios. The availability of eBooks and PDF materials ensures accessibility for learners worldwide, fostering a data-driven approach in modern industries. This practical orientation makes applied statistics indispensable for professionals seeking to extract meaningful insights from data.

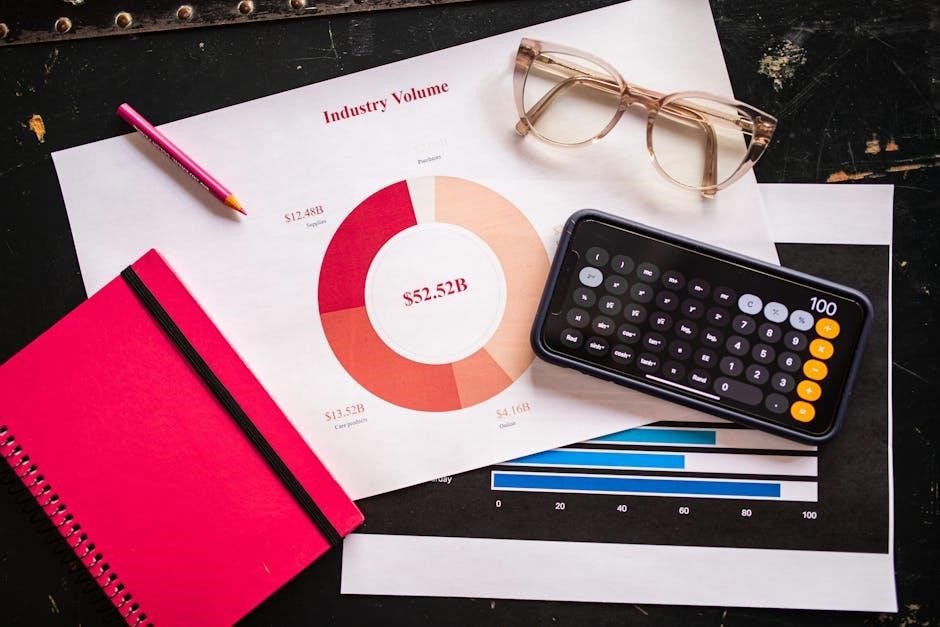

Importance of Statistics in Business Decision-Making

Statistics plays a pivotal role in business decision-making by enabling organizations to analyze data, identify trends, and make informed choices. It provides a framework for understanding market dynamics, consumer behavior, and operational efficiency. By applying statistical tools like regression analysis and hypothesis testing, businesses can forecast future outcomes, assess risks, and optimize strategies. For instance, statistical methods help companies identify customer preferences, monitor production processes, and evaluate the impact of marketing campaigns. This data-driven approach reduces uncertainty and enhances the accuracy of decisions. In economics, statistics is equally vital for policy-making, economic forecasting, and understanding macroeconomic trends. The ability to interpret statistical results empowers businesses to stay competitive and adapt to changing market conditions, making it an indispensable skill in modern commerce and economic analysis.

Key Concepts and Terminology

In applied statistics for business and economics, key concepts include measures of central tendency (mean, median, mode) and variability (standard deviation, range). Probability theory underpins statistical inference, enabling predictions and risk assessments. Sampling distributions allow estimation of population parameters, while hypothesis testing (Z-tests, T-tests) aids in decision-making. Regression analysis examines relationships between variables, and time-series analysis forecasts future trends. Terms like confidence intervals, p-values, and correlation coefficients are essential for interpreting data. Understanding these concepts is crucial for applying statistical methods effectively in business and economic contexts, ensuring accurate analysis and informed decision-making. These tools help businesses and economists uncover patterns, predict outcomes, and optimize strategies, making statistics a cornerstone of data-driven environments.

Statistical Methods for Business and Economics

Statistical methods like regression analysis, hypothesis testing, and time-series forecasting are essential for analyzing business data, enabling informed decision-making and predictive modeling in economic contexts effectively.

Descriptive Statistics: Measures of Central Tendency and Variability

Descriptive statistics summarize data, providing insights into central tendency (mean, median, mode) and variability (range, variance, standard deviation). These measures help businesses understand data distributions, identify trends, and make informed decisions. The mean is the average value, while the median represents the middle value, and the mode is the most frequent value. Variability measures, such as the standard deviation, indicate data dispersion. Understanding these concepts is crucial for analyzing market trends, customer behavior, and financial performance. Textbooks like Doane, Webster, and Leekley emphasize their practical applications in real-world business scenarios, making them essential tools for data-driven decision-making in economics and management.

Probability Theory and Its Applications

Probability theory is a cornerstone of applied statistics, enabling businesses to model uncertainty and make informed decisions. It involves calculating probabilities of events, such as market trends or consumer behavior. Key concepts include probability distributions (e.g., normal, binomial), Bayes’ theorem, and expected value. These tools help in risk assessment, forecasting, and scenario analysis. In economics, probability theory aids in understanding stochastic processes and policy impacts. Textbooks like Doane and Webster highlight practical applications, such as predicting stock prices or analyzing customer purchasing patterns. By applying probability theory, businesses can quantify uncertainty and make strategic decisions, ensuring resilience in dynamic markets. This foundation is essential for advanced statistical methods in both business and economics;

Sampling Distributions and Estimation

Sampling distributions are crucial in applied statistics for understanding the variability of sample statistics, such as the sample mean or proportion. They form the basis for estimation, allowing businesses to make inferences about populations from sample data. Key concepts include point estimation, interval estimation, and confidence levels. These methods help quantify uncertainty and provide reliable estimates for decision-making. In business and economics, sampling distributions are applied in market research, quality control, and policy evaluation. Textbooks like Doane and Webster emphasize practical applications, such as estimating market sizes or analyzing customer satisfaction. By leveraging sampling distributions, organizations can reduce errors and improve the accuracy of forecasts, ensuring data-driven strategies are both efficient and effective. This foundational concept is integral to advancing analytical capabilities in business and economic contexts.

Hypothesis Testing: Z-Tests and T-Tests

Hypothesis testing is a critical tool in applied statistics for making inferences about populations based on sample data. Z-Tests are used to determine whether there is a significant difference between a sample mean and a population mean, assuming the population variance is known. T-Tests, on the other hand, are applied when the population variance is unknown, often comparing the means of two groups. Both tests help businesses and economists assess the validity of assumptions or identify trends. For instance, Z-Tests can evaluate customer satisfaction scores, while T-Tests might compare sales performance before and after a marketing campaign. These methods are widely discussed in textbooks like Doane and Webster, emphasizing their practical applications in decision-making and strategy formulation. By using hypothesis testing, organizations can make data-driven decisions with confidence, ensuring accuracy and reliability in their analyses.

Chi-Square Tests for Categorical Data

Chi-Square tests are widely used in applied statistics to analyze categorical data, helping businesses and economists determine if observed frequencies significantly differ from expected frequencies. These tests are non-parametric, making them suitable for nominal or ordinal data without requiring normal distribution assumptions. Common applications include market research, where Chi-Square tests can assess customer preferences or the effectiveness of marketing campaigns. For instance, they might evaluate if product color influences purchase decisions. Textbooks like Doane and Webster highlight their importance in understanding relationships between categorical variables. By applying Chi-Square tests, organizations can identify patterns and associations within their data, enabling informed decision-making and strategic planning. This method is particularly valuable for validating hypotheses in real-world business and economic scenarios, where categorical data analysis is crucial for understanding consumer behavior and market trends.

Applied Tools and Techniques

Applied tools like regression, time-series analysis, ANOVA, and non-parametric tests enable businesses to analyze data and solve real-world economic problems effectively using statistical methods.

Regression Analysis: Simple and Multiple Regression

Regression analysis is a powerful tool in applied statistics, used to establish relationships between variables. Simple regression involves one independent variable to predict the outcome of a dependent variable, while multiple regression extends this by incorporating multiple predictors. Both methods are widely applied in business and economics to forecast trends, such as sales or market demand, and to analyze the impact of various factors on outcomes. For instance, businesses use regression to understand how advertising spend influences revenue or how interest rates affect consumer spending. By identifying cause-effect relationships, regression models enable data-driven decision-making and strategic planning. These techniques are also essential for predictive analytics, helping organizations anticipate future outcomes based on historical data.

Time-Series Analysis and Forecasting

Time-series analysis is a statistical method used to examine and predict data collected over time. It identifies patterns, trends, and seasonal variations in sequential data, enabling businesses to forecast future outcomes. Techniques like moving averages, exponential smoothing, and ARIMA models are commonly applied to predict sales, inventory levels, or economic indicators. This approach helps organizations make informed decisions by leveraging historical data to anticipate future trends. For example, businesses use time-series analysis to project demand, optimize production schedules, and manage financial risks. Accurate forecasting enhances strategic planning and resource allocation, making it a vital tool in applied statistics for business and economics.

Analysis of Variance (ANOVA) and Its Applications

Analysis of Variance (ANOVA) is a statistical technique used to compare means among three or more groups to determine if at least one group differs significantly. In business and economics, ANOVA is applied to test hypotheses about differences in performance, customer behavior, or economic indicators across various scenarios. For instance, it can compare sales performance across regions or evaluate the effectiveness of different marketing strategies. ANOVA helps identify significant variations, enabling informed decision-making. Its applications extend to quality control, where it assesses process consistency, and in market research, where it analyzes consumer preferences. By providing insights into group differences, ANOVA is a powerful tool for optimizing business strategies and economic policies.

Non-Parametric Tests and Their Uses

Non-parametric tests are statistical methods that don’t require data to meet specific distributional assumptions, making them versatile for analyzing diverse datasets. In business and economics, these tests are particularly useful when dealing with small sample sizes, skewed distributions, or ordinal data. Common non-parametric tests include the Wilcoxon rank-sum test for comparing two independent groups and the Kruskal-Wallis test for multiple group comparisons. These methods are applied in market research to analyze customer preferences, in economics to study income distributions, and in quality control to assess process variability. Their flexibility and robustness make non-parametric tests invaluable for addressing complex, real-world challenges in business and economic analysis.

Real-World Applications in Business and Economics

Applied statistics drives decision-making in market research, consumer behavior analysis, quality control, and financial risk assessment, enabling businesses to optimize operations and economists to forecast trends accurately.

Using Statistics in Market Research and Consumer Behavior

Statistics plays a pivotal role in market research and understanding consumer behavior by analyzing data to identify trends, preferences, and patterns. Businesses use statistical tools to collect and interpret data from surveys, focus groups, and customer feedback. Techniques such as regression analysis and hypothesis testing help predict consumer responses to new products or pricing strategies. By applying statistical methods, companies can segment markets, measure brand loyalty, and evaluate the effectiveness of marketing campaigns. Textbooks like Applied Statistics for Business and Economics by Webster and Applied Statistics in Business and Economics by Doane emphasize the importance of data-driven insights in making informed marketing decisions. These resources provide practical examples and methodologies to apply statistical concepts to real-world business scenarios, ensuring companies stay competitive and responsive to consumer needs. This approach enables firms to allocate resources efficiently and tailor strategies to meet market demands effectively.

Statistical Quality Control in Production Processes

Statistical quality control is a critical application of applied statistics in ensuring product consistency and reliability. By analyzing data from production processes, businesses can identify deviations and implement corrective actions. Techniques like control charts and Six Sigma methodologies enable companies to monitor variability and maintain high standards. This approach reduces defects, minimizes waste, and enhances customer satisfaction. Textbooks such as Applied Statistics for Business and Economics by Webster and Doane provide detailed methodologies for implementing quality control measures. These tools help organizations optimize production processes, leading to cost savings and improved efficiency. By leveraging statistical methods, firms can ensure their products meet quality benchmarks, fostering trust and loyalty in the marketplace. This data-driven approach is essential for maintaining a competitive edge in today’s global economy.

Financial Data Analysis and Risk Assessment

Applied statistics plays a pivotal role in financial data analysis and risk assessment, enabling businesses to make informed decisions. By analyzing historical and current financial data, organizations can identify trends, predict future outcomes, and mitigate potential risks. Statistical tools such as regression analysis, hypothesis testing, and time-series forecasting are essential for evaluating investment opportunities, managing portfolios, and assessing market volatility. These methods help in understanding the relationship between financial variables, such as stock prices, interest rates, and economic indicators. Textbooks like Applied Statistics for Business and Economics by Doane and Webster provide comprehensive guidance on these techniques. Effective use of statistical methods in finance ensures better risk management, optimal resource allocation, and enhanced profitability, making it a cornerstone of modern financial decision-making.

Economic Forecasting and Policy Making

Applied statistics is instrumental in economic forecasting and policy making, enabling governments and organizations to predict economic trends and make data-driven decisions. Statistical methods such as regression analysis, time-series forecasting, and econometric modeling are used to analyze historical data and project future economic conditions. These techniques help in understanding the relationships between economic variables, such as GDP, inflation, and unemployment rates. By leveraging statistical tools, policymakers can evaluate the potential impact of economic policies and develop strategies to mitigate risks. Textbooks like Applied Statistics for Business and Economics provide detailed methodologies for conducting such analyses. Accurate economic forecasting ensures informed decision-making, fostering sustainable growth and stability in both developed and emerging economies.

Textbooks and Resources for Applied Statistics

Prominent textbooks like Applied Statistics for Business and Economics by Doane, Webster, and Leekley provide comprehensive guides for statistical methods and real-world applications in PDF formats.

Popular Textbooks: Doane, Webster, and Leekley

Doane, Webster, and Leekley are renowned authors of textbooks on applied statistics, offering detailed explanations of statistical methods. Their books, such as Applied Statistics for Business and Economics, are widely used in academic and professional settings. These textbooks emphasize practical applications, making complex concepts accessible. They cover topics like descriptive statistics, probability, and hypothesis testing, with real-world examples. Many of these textbooks are available in PDF format, providing easy access for students and professionals. The clear structure and concise explanations make them invaluable resources for learning applied statistics. These authors have contributed significantly to the field, ensuring their works remain essential for understanding statistical tools in business and economics.

Online Resources and PDF Materials

Online resources and PDF materials provide accessible learning tools for applied statistics; Websites like OpenLibrary.org and Internet Archive offer free PDF downloads of textbooks, including works by Doane, Webster, and Leekley. These resources cover essential topics such as probability, sampling, and regression analysis. Many academic institutions also provide PDF lecture notes and study guides, enhancing accessibility for students. Additionally, platforms like ResearchGate and Google Scholar host PDF papers and eBooks, offering in-depth insights into statistical methods. These online materials are invaluable for self-study and academic research, ensuring that learners can access high-quality content without cost barriers. They cater to both beginners and advanced learners, making applied statistics more accessible than ever.

Software Tools: Excel, R, Python, and SPSS

Software tools like Excel, R, Python, and SPSS are indispensable in applied statistics for business and economics. Excel offers user-friendly features for data visualization and basic analysis. R is renowned for its extensive libraries, enabling complex statistical modeling. Python, with libraries like Pandas and NumPy, excels in data manipulation and machine learning. SPSS is widely used for advanced data analysis and statistical testing. These tools facilitate efficient data processing, enabling businesses to make informed decisions. They are also essential for tasks such as regression analysis, hypothesis testing, and forecasting. By leveraging these software tools, professionals can streamline workflows and enhance the accuracy of statistical outcomes, making them crucial for modern business and economic applications.

Applied statistics is vital for informed decision-making in business and economics, offering practical tools for data analysis and problem-solving, supported by resources like textbooks and software tools.

Applied statistics empowers businesses and economists with data-driven insights, enabling informed decisions through tools like regression, hypothesis testing, and time-series analysis. Key concepts include descriptive statistics, probability theory, and sampling distributions. Popular textbooks by Doane, Webster, and Leekley provide comprehensive guidance, while software tools such as Excel, R, and Python facilitate practical applications. Real-world uses span market research, quality control, and economic forecasting. The future of applied statistics lies in advancing analytical techniques and integrating technology for better decision-making. These resources and methods collectively enhance the ability to interpret and apply statistical results effectively in dynamic business and economic environments.

The Future of Applied Statistics in Business and Economics

The future of applied statistics in business and economics lies in advancing analytical techniques and integrating technology. Artificial intelligence, machine learning, and big data will drive more precise forecasting and decision-making. Tools like Python and R will remain essential for handling complex datasets. As businesses evolve, the demand for professionals skilled in statistical analysis will grow. Emerging trends include predictive analytics and real-time data processing, enabling faster and more accurate insights. Additionally, the integration of statistics with other disciplines, such as sustainability and behavioral economics, will expand its applications. Staying updated with these advancements will be crucial for professionals to remain competitive in a data-driven world.